Collections and debt purchase heading into 2023 – state of the sector

04 November 2022

(0 Comments)

|

Chris Leslie is CEO of Credit Services Association

|

|

As the wider economic environment continues to dominate the news agenda, it’s worth taking stock where the UK’s debt collection and debt purchase sector fits into this picture, what risks and prospects lie ahead and what should be the collective policy

priorities as we head towards 2023.

At the CSA’s recent UK Credit & Collections Conference in Manchester there was much talk about the cost-of-living issues facing consumers, though these pressures were mostly anticipated to begin squeezing repayment rates as the winter months draw

on and extra heating needs are accompanied by highly inflated energy bills. What few anticipated was that the change of administration to the Truss/Kwarteng leadership would be so quickly accompanied by a series of fiscal commitments that upset the

gilt bond markets, putting even further upward pressure on mortgage and Bank of England interest rates. We are now in a position where, while the state will subsidise household energy costs to a very large degree, consumers look set to still face

significant rising costs accompanied by higher personal finance and housing costs. With a typical two-year fixed mortgage now knocking on six percent, this is predicted to absorb 27% of household incomes as opposed to around 17% housing costs that

most have been used to in recent times. In other words, the squeeze on available income after accounting for essential expenditure is still set to get worse in the coming year – which in turn will raise the number of households in deficit budgets

and make the collections challenge harder still.

We can therefore anticipate a difficult economic climate in which UK consumers will continue to borrow but if we have now moved past the era of ultra-low interest rates, which seems likely even if the Government calms the markets somewhat, then default

rates are likely to increase and the attention of policy-makers and the media on finance costs and forbearance needs will also increase. All the more reason, then, for the collections sector to maintain the creditable progress made over recent years

in engaging professionally with customers, upholding high standards and working with creditors to maintain credit availability by helping lenders recover sums owed.

Public perceptions will continue to play a large part in the reputational standing of the collections sector – something that regulators and the Government will monitor closely. If the cost of credit is going to be increasingly under the spotlight, it

is imperative that the wider public understand that collections isn’t something done for the sake of it, but is a necessary part of the process of maintaining ongoing credit facilities at affordable levels for as many people as possible.

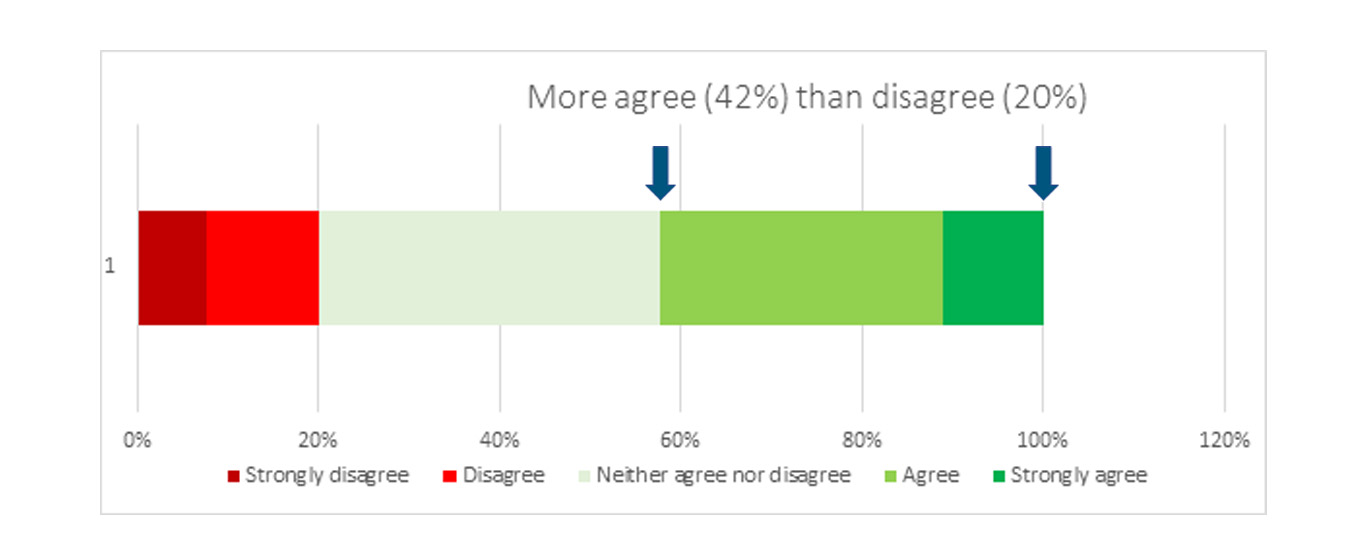

Fortunately, the evidence suggests that the numbers of people who ‘get it’ far exceed those who do not believe that collections is a necessary function. The Credit Services Association commissioned pollsters Opinium in the summer and asked a nationally

representative sample whether they agreed or disagreed with the statement that “It is reasonable for people who miss payments on the money they owe to be contacted by a debt collection agency”. By a ratio of more than two to one, 42% felt this was

in indeed ‘reasonable’ versus only 20% who felt it was ‘unreasonable’, which a sizeable remaining section of the population unsure (see graph below). This suggests that, while further financial education is always important in sharing with the public

how the financial services cycle operates, we have strong grounds for optimism that more people understand why debt collection agencies must exist than those who do not.

The CSA’s latest survey of member firms suggests that the UK collections sector now holds over £30 billion of consumer debt for collection, across more than 25 million customer accounts. In terms of commercial debt, the sector holds £4billion across 1.5million

accounts. So there is an ongoing and significant role for collections and debt purchase agencies to play in the economy, not to mention the employment contribution made by CSA member firms who employ over 11,000 people across the country.

Despite the role played by our sector and the level of public awareness, we consistently see myths and misconceptions repeated often in heightened media terms, which can damage consumer confidence in engaging with collections agencies. The truth is that

early dialogue and conversations between customers, creditors and their collections agencies remain one of the best ways to tackling problem debt, addressing difficulties and accessing forbearance that some people are unaware might be available. Earlier

this year we saw the positive development of the Money & Pensions Service emphasise on its public website the potential gains for consumers in engaging directly with DCAs. Signposting to independent debt advice is of course extremely important.

But it is also essential for those who shape public opinion in money and finance issues to state the obvious too often neglected; that picking up the phone and talking with lenders and collections agencies is likely to be a beneficial way forward

for all concerned - the sooner the better.

We can take heart that our sector has a reasonable track record in providing good customer outcomes. One way to measure this is to examine complaint levels, and while of course there will always be customer complaints, CSA member firms tell us that these

tend to arise on less than a fifth of one percent of accounts, from which around 27% are ‘upheld’ by firms when examined further. This complaints rate is echoed by the complaints trend received by the Credit Services Association in respect of allegations

that a member firm has breached our Code of Practice, where we have an ‘uphold’ rate of 34% this year. So too is this reflected in the complaints data reported recently by the independent Financial Ombudsman Service, who say that on 1,101 cases 24%

were upheld, which compares well with the 43% uphold rate across all other financial services types.

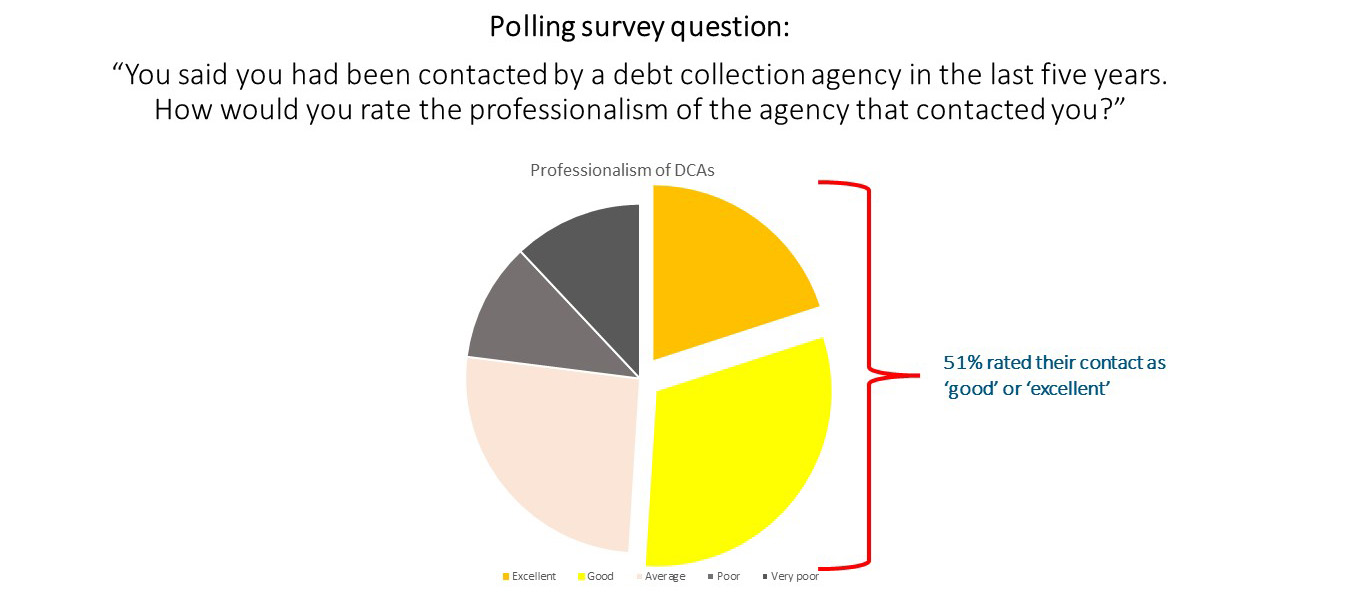

Our Opinium polling asked those who said they had been contacted by a debt collection agency in the last five years to rate the professionalism of the agency that contacted them. The results were pleasingly positive, with a majority responding that their

contact experience had been ‘good’ or ‘excellent’ (see chart below). This is a finding that would probably confound those who are in the habit of demonising the process of debt recovery, who tend to paint a negative portrait of a heavy-handed process

placing additional stress on those in debt. The reality is that many customers are pleasantly surprised that helpful and patience support is available, together with options to rephase payments over a longer time scale or reach a settlement arrangement

involving significant forbearance.

The next few years will be testing. The end of the era of ultra-low interest rate comes at a time when new regulations such as the FCA’s Consumer Duty are being introduced. The collections sector is well placed to cope – and navigate possible reforms

to insolvency on the horizon and debt relief initiatives such as the Statutory Debt Repayment Plans. If collections agencies and debt purchases continue to be guided by the principles of the CSA’s Code of Practice they will succeed in further bolstering

their professionalism, resolving problem debts for customers and proving their value in maintaining credit in the economy more widely. This article first appeared in Credit Management magazine.

|